No products in the cart.

Blue Dart

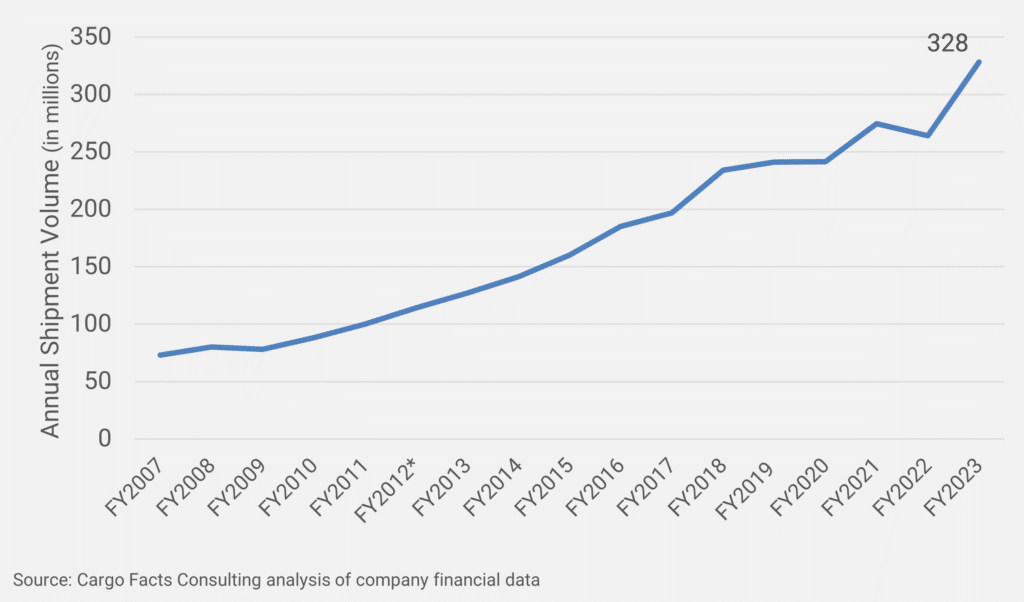

Blue Dart Aviation, originally the air arm of Indian express company Blue Dart Express, was spun out as a standalone carrier in 2004 when DHL acquired majority ownership of Blue Dart Express. However, Indian ownership ended in late June 2015 when Blue Dart Express raised its stake in Blue Dart Aviation from 49% to 75%, effectively making Blue Dart Aviation a subsidiary of DHL Express. Blue Dart serves the seven largest cities in India and primarily flies at night, allowing late cut-off times and on-time early morning deliveries (see Figure 1).

Figure 1 – Blue Dart Air Network, November 2022

Blue Dart offers air freight, ground, and air express, charters, and trucking services through its partnerships with DHL Express, DHL eCommerce LLP, DHL Supply Chain, and DHL Global Forwarding. This synergy allows Blue Dart to reach more than 220 countries and territories through its time-definite and day-definite delivery services providing secure and dependable consignment delivery to over 55,000+ locations across India. Moreover, the company offers specialized delivery services such as Freight on Delivery (FOD), Freight on Value (FOV), Point to Point (P2P), Temperature Controlled Logistics (TCL), Cash on Delivery (COD), and Digital Prepaid Cards. Blue Dart also continued its drone delivery trials under the Med-Express Consortium, focusing on improving healthcare logistics in Telangana through the ‘Medicine from the Sky’ project. These trials are meant to safely and reliably transport healthcare items like medicines and vaccines, especially to remote areas.

The Indian economy is set to experience robust growth in 2023 and 2024, with a projected 7% expansion in the fiscal year ending March 2023, driven by credit growth in the MSME sector. For the fiscal year ending March 31, 2024, growth is expected to be between 6.7% and 7%. The IMF has raised its growth forecast for India to 6.3% for the current fiscal year. Despite a slight slowdown, the service sector, which accounts for over 50% of India’s GDP, remains strong, with consistent growth since August 2021. India’s GDP grew by 7.6% in the July-September 2023 quarter, exceeding expectations and highlighting its position as the fastest-growing major economy.

Blue Dart took advantage of this economic growth in India and managed well in 2022, expanding its services, focusing on customer-centric culture, and embracing technology. It supported India’s logistics improvements and remained a reliable and responsive partner. Blue Dart’s financial year 2022-23 reflected agility and profitability, with income from operations at $637 million (52 billion INR) and a profit after tax of $45 million (3.6 billion INR). Blue Dart continues to lead in express logistics, investing in technology and people. The e-commerce sector in India is set to experience rapid growth, with Blue Dart offering efficient solutions and expanding its online presence.

Figure 2 shows the increase in Blue Dart’s revenue to $637 million, with a 1% decrease in profit margin from 2021 to 10% FY2023, which reflects the impact of inflation and rising operational costs, such as labor, maintenance, and fuel. The slight reduction in profit margin amidst revenue growth aligns with the industry navigating challenges such as increased costs and lower yields, which are common in the logistics industry during inflationary periods. The current financials highlight Blue Dart’s strategic responses to external economic pressures, such as adjusting pricing strategies and optimizing routes to maintain profitability.

Figure 2 – Blue Dart Revenue and EBIT Margin FY2007 – FY2023

The airline currently operates eight aircraft. Six of them 757-200Fs, with two 737-800 freighter aircraft added to the fleet at the end of March 2023. The recently added 737-800Fs were purchased from German logistics company DHL for an estimated $50.6 million. With the addition of the new aircraft Blue Dart’s payload capacity is soon to be 500+ tonnes per night.

Blue Dart’s expansion with the newly added 737-800Fs, is set to serve the growing demand from smaller towns in the Bharat market. Furthermore, the significant expansion in demand generation originating from emerging towns in Tier II, III, and IV cities will also serve as a substantial catalyst for growth. Along with fleet expansion, Blue Dart is also actively investing in new technology such as AI and drone technology to increase efficiency in their last-mile delivery operations.

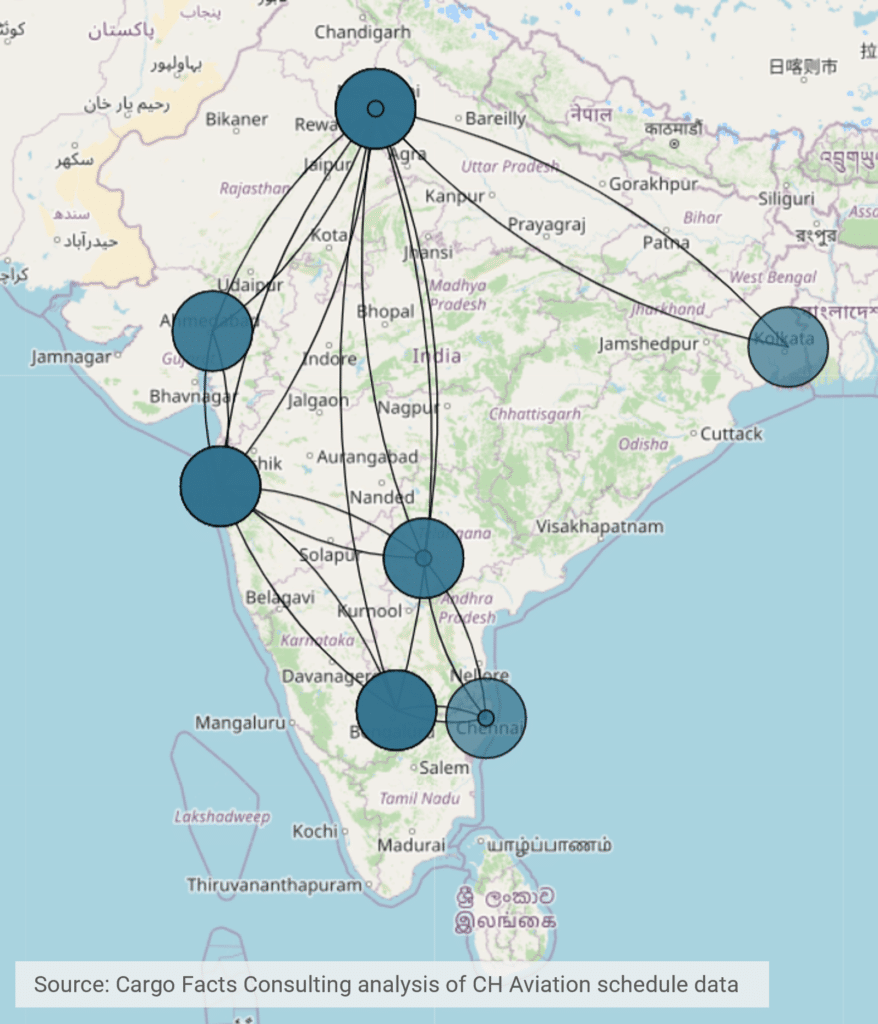

Emphasizing innovation, reach expansion, improved transit times, and the activation of emerging towns (Tier-II, III, and IV), Blue Dart continuously strives to enhance its distribution channels and meet customer expectations. During the fiscal year ending March 31, 2023, the company successfully managed over 327,371,000 domestic shipments and 823,000 international shipments, collectively weighing over 11,54,000 tonnes. These efforts underscore Blue Dart’s role as a prominent player in the logistics sector, catering to diverse stakeholders and maintaining operational excellence.

Figure 3 – Blue Dart Air and Ground Shipments FY2007 – FY2023

As shown in figure 3, Blue Dart saw its demand increase significantly from 2021 by almost 25% from 264 in FY2021 to 328 million shipments in FY2023 as e-commerce growth and the emerging markets in India took hold.

In the last fiscal year, Blue Dart delivered solid financial performance, with revenue escalating by approximately 17% due to a marked increase in volumes, despite facing some challenges. The company’s profit margin, however, experienced a slight downturn, with a year-over-year decrease in profit after tax by about 2%. Blue Dart’s focus remained on enhancing operational efficiency through significant investments in capacity, digitalization, and automation, although these efforts didn’t fully offset the profit margin decline.