No products in the cart.

Fulfillment Channels: The Mechanics of E-commerce

Understanding where to find the highest quality opportunities in e-commerce logistics requires an understanding of the mechanics of e-commerce fulfillment and competitive dynamics across the fulfillment chain

E-commerce Fulfillment vs. Traditional Retail Chains

Traditional retail and e-commerce fulfillment channels differ fundamentally in nature and involve distinct sets of providers. Traditional retail fulfillment largely involves the wholesale transportation of large lots between factories, distribution centers, and retail outlets, utilizing linehaul truck, shipping, and air transportation. Figure 1 provides a simplified overview of traditional retail fulfillment.

Figure 1 – Traditional Retail Fulfillment

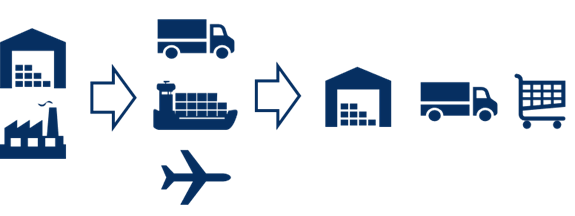

The key transportation providers in traditional retail fulfillment are third-party logistics providers, freight forwarders, shipping lines, airlines, and trucking companies. In some markets, rail transport also plays a role in shipping containers from ports to distribution centers, with shipment sizes typically being full or partial container or truck loads. International airfreight in traditional retail fulfillment is controlled by the top freight forwarders (see Figure 2)

Figure 2 – Top 25 Freight Forwarders, based on 2022 Air Tonnage

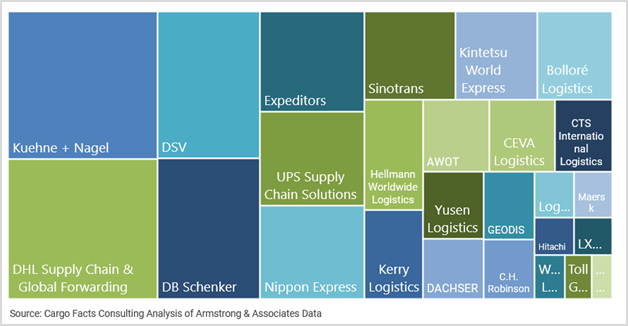

In contrast, e-commerce retail fulfillment from factory to distribution center shares similarities with the traditional retail chain, but it primarily centers around the movement and delivery of small packages or single items, both domestically and across borders. While top freight forwarders play a role in e-commerce fulfillment, they are not particularly geared towards this business. Figure 3 provides a simplified overview of the e-commerce fulfillment chain.

Figure 3 – E-commerce Retail Fulfillment

In e-commerce fulfillment, a customer – either a consumer or business – places an order which is then picked, packed, and dispatched from a seller or distribution center using an in-house or third-party logistics system. This process may involve pick-up, origin handling, sorting and consolidation, road and air line haul, customs clearance, destination sorting and handling, and last-mile delivery to homes, businesses, or pick-up points such as retail outlets and parcel lockers. Large e-tailers use predictive analytics to estimate what customers will order and when allowing them to pre-stock items in delivery vehicles or local distribution points for instant or rapid delivery.

In e-commerce fulfillment, a customer – either a consumer or business – places an order which is then picked, packed, and dispatched from a seller or distribution center using an in-house or third-party logistics system. This process may involve pick-up, origin handling, sorting and consolidation, road and air line haul, customs clearance, destination sorting and handling, and last-mile delivery to homes, businesses, or pick-up points such as retail outlets and parcel lockers. Large e-tailers use predictive analytics to estimate what customers will order and when allowing them to pre-stock items in delivery vehicles or local distribution points for instant or rapid delivery.

For domestic e-commerce, customers are generally provided with real-time or near-real-time tracking information. However, in cross-border e-commerce, due to the fulfillment options chosen by sellers, tracking information is often not available to the customer. E-commerce fulfillment involves more parties than traditional retail fulfillment, including postal companies, express companies, courier companies, independent contractors, and wholesale transportation capacity providers such as airlines or trucking companies. Traditional third-party logistics providers and freight forwarders play a lesser role in e-commerce fulfillment, either because platforms manage their logistics or rely on specialist e-commerce consolidators or other providers for transport organization. The way shipments are injected into third-party carriers’ systems varies, offering interface possibilities at all stages of the chain.

Domestic E-Commerce Fulfillment

Fulfillment in domestic networks primarily relies on ground transportation, such as trucks and vans. For our analysis, ‘domestic’ also includes intra-EU or other customs union markets that essentially operate like domestic markets. Some premium traffic moves by air in express or dedicated networks. Driven by predictive analytics, platforms like Amazon also move inventory between fulfillment centers using air freight to ensure shorter delivery times to market once actual orders have been placed. Some e-tailers are also trialing delivery by drone or other automated vehicles, but so far, this type of delivery remains in the experimental stage. Figure 4 provides an overview of the mechanics of domestic and intra-regional (customs union) fulfillment. The choice of fulfillment channel and carrier is generally determined either by the seller or the e-commerce platform, although in many cases, customers can choose a shipping speed and occasionally are also given a choice of different parcel operators.

Figure 4 – Domestic Fulfillment

Cross-Border E-Commerce Fulfillment

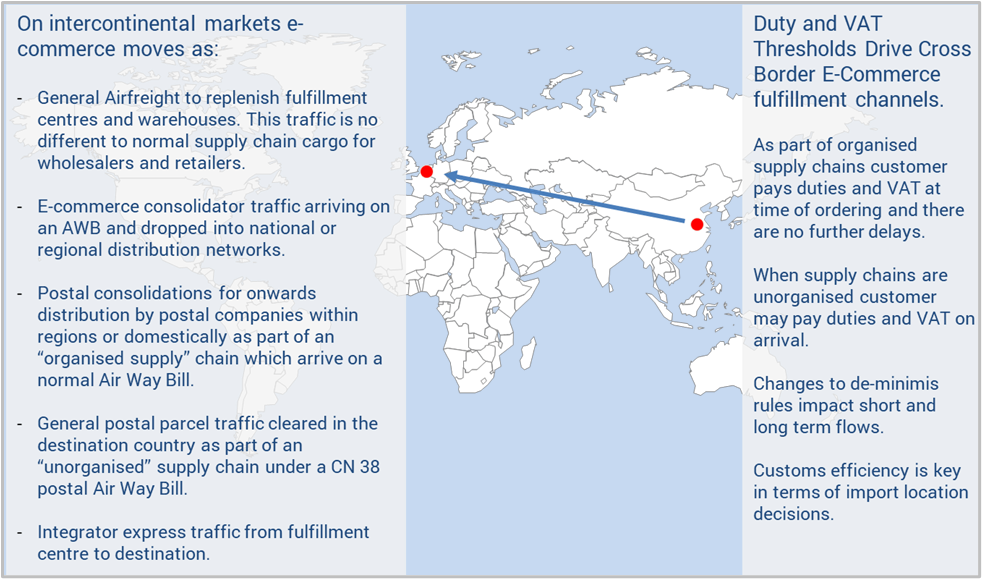

Cross-border e-commerce generally involves the use of airfreight, with subsequent forwarding through postal, express, or other parcel networks (see Figure 5). Fulfillment channels are driven by customs and tax regulations and practices, particularly rules relating to de-minimis, tax-free thresholds, and collection procedures. Changes to these regulations fundamentally impact the flow of cross-border e-commerce.

Figure 5 – Cross-Border Fulfillment Channels

Postal, express companies and e-commerce consolidators are key players in cross-border e-commerce. Traditional forwarders and 3PLs have tended to remain focused on their traditional business-to-business industrial operations. Most of the important e-commerce consolidators are local Chinese companies, which are not well-known outside China. The replenishment of e-commerce provider warehouse and fulfillment center inventory is not considered e-commerce in our analysis. This type of traffic is no different from normal consumer goods and supply chain cargo moving by air (and ocean freight) for the replenishment of wholesalers and retailer stocks. As such, it has been excluded from our analysis.

However, as e-commerce gains a greater share of overall retail volumes, we foresee a potential shift in customer preferences, favoring wholesale traffic to e-commerce warehouses and moving away from the distribution centers of traditional wholesale and retail companies.